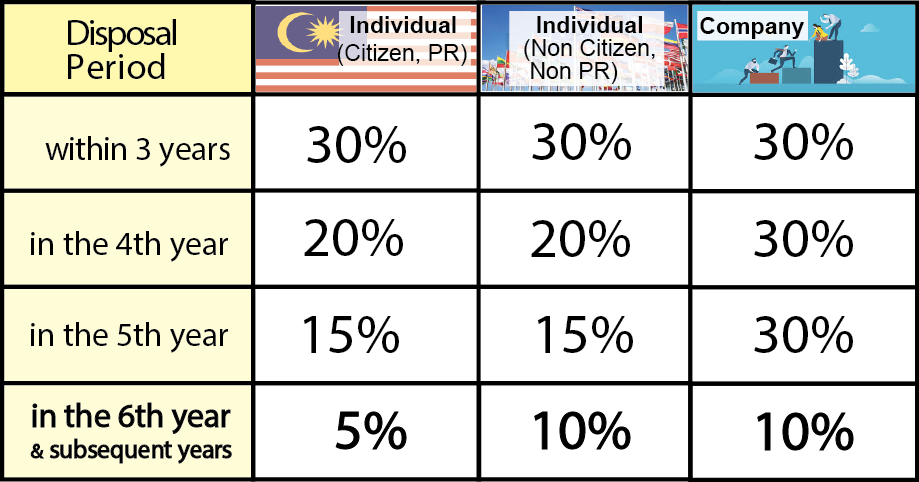

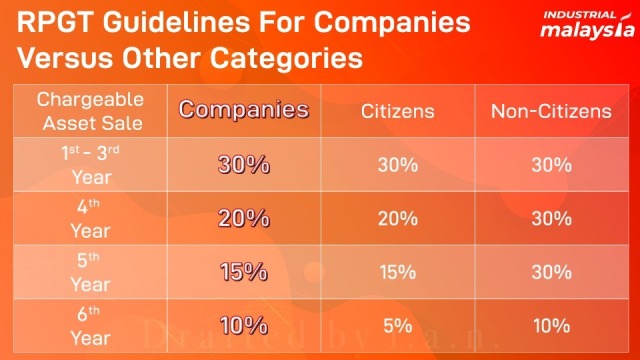

RPGT is charged on chargeable gain from. Starting from January 1st 2014 all properties disposed within three years or less is subjected to 30 RPGT previously 15 for two years and below and 10 for three years and below.

Real Property Gains Tax Valuation And Property Management Department Portal

Disposal of assets to REITs and Property Trust Funds.

. The executor is the person named in a will who administers the estate that is the property of a deceased. RPGTA was introduced on 7111975 to replace the Land Speculation Tax Act 1974. This Act may be cited as the Real Property Gains Tax Act 1976 and shall be deemed to have come into force on 7 November 1975.

In general Real Property Gain Tax RPGT is applicable to all residents as long as a profit is made from selling their property within Malaysia be it whether they are Malaysian citizens or foreigners. For example individual Malaysian citizen and partners. Based on the Real Property Gains Tax Act 1976 RPGT is a tax on chargeable gains derived from the disposal of property.

Properties that are disposed within four years of purchase are subjected to 20 tax and 15 for five years. Part II Schedule 5 RPGT Act. According to the Real Property Gains Tax Act 1976 RPGT is a form of Capital Gains Tax in Malaysia levied by the Inland Revenue LHDN.

The tax is levied on the gains made from the difference between the disposal price and acquisition price. What is Real Property Gain Tax RPGT. Gain accruing to an individual who is a citizen or a permanent resident in respect of the disposal of one private residence.

Taxation of chargeable gains 4. Short title and commencement 2. In Malaysia Real Property Gains Tax RPGT is a tax imposed by the Inland Revenue Board LHDN on chargeable gains which find their source in the disposal of real property.

As proposed by Tengku Datuk Seri Zafrul Abdul Aziz the RPGT rates as per Schedule 5 of the Real Property Gains Tax Act 1976 RPGT Act will be as follows with effect from 1 January 2022 provided that the 2022 Malaysian Budget proposals and the Finance Bill 2021 2 pass through the parliament and subsequently gazetted accordingly. This fact is specified in the Real Property Gains Tax Act 1976 Act 169. Interpretation PART II IMPOSITION OF THE TAX 3.

REAL PROPERTY GAINS TAX ACT 1976 Click here to see Annotated Statutes of this Act PART I PRELIMINARY SECTION 1Short title and commencement 2Interpretation PART II IMPOSITION OF THE TAX 3Taxation of chargeable gains 4Rate of tax 5Situation of interests options etc. Short title and commencement 2. Real Property Gains Tax.

Real Property Gains Tax RPGT is a tax levied by the Inland Revenue Board IRB on chargeable gains derived from the disposal of real property. Ad From Trusted Sellers Buy What You Love. According to the Real Property Gains Tax Act 1976 RPGT is a form of Capital Gains Tax levied by the Inland Revenue LHDN.

In other words the Real Property Gains Tax Act 1976 the RPGT Act only applies to the sale but not the purchase of any landed property. This tax is provided for in the Real Property Gains Tax Act 1976 Act 169. Real Property Gains Tax Act 1976 The RPGT Act which came into force on 7 November 1975 provides for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto.

Under Section 13 of the Real Property Gains Tax Act 1976 both the buyer and the seller will need to file a tax return to the IRB within 60 days from the date of the Sale and Purchase Agreement or the unconditional date by filling Borang CKHT 1A for the seller or disposer and Borang CKHT 2A for the buyer. RPGT is generally classified into 3 tiers. No gains tax is payable if you buy a landed property.

Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. Both Acts were introduced to restrict the speculative activity of real estate. 1 In this Act unless the context.

Rate of tax 5. In 2021 the Malaysian government announced an update to the RPGT Act in Budget 2022 which introduced a new change to RPGT by abolishing the 5 RPGT from the sixth year onwards for individuals who. Foreigners and companies will also see an increase in RPGT rates from 5 to 10.

LAWS OF MALAYSIA Act 169 REAL PROPERTY GAINS TAX ACT 1976 ARRANGEMENT OF SECTIONS P ART I PRELIMINARY Section 1. A chargeable gain is a profit when the disposal price is more than the purchase. An amount of RM10000 or 10 of the chargeable gain whichever is greater accruing to an individual.

To prevent speculative investment RPGT threshold is divided into years of ownership and type of entities. Tax payable RPGT rate x net chargeable gain The RPGT rate imposed depends on the entity of the disposer whether a permanent resident individual citizen or company and the period of ownership of the property. Real Property is defined by the RPGT Act as any land situated in Malaysia and any interest option.

2013 RPGT 2014 RPGT 1st year 15. The Aftermath of Budget 2019 towards the Real Property Gains Tax RPGT During the presentation of Budget 2019 the most recent RPGT amendment was made where Malaysians who are selling off their property in the sixth and subsequent years of ownership will now have to pay a 5 RPGT. RPGT introduced in 1975.

Real Property Gains Tax 3 LAWS OF MALAYSIA Act 169 REAL PROPERTY GAINS TAX ACT 1976 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. Real Property Gains Tax RPGT Rates RPGT rates differs according to disposer categories and holding period of chargeable asset. In the above example where your gain was RM250000 the RPGT payable would be RM 50000.

It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price. Effective Jan 1 2019 the RPGT has been increased for disposal of a property from the sixth year onwards. Situation of interests options etc.

Gains by an individual who is a citizen and permanent resident of malaysia from the disposal of real property and shares in a real property company each a chargeable asset in the sixth and subsequent years after the acquisition date of the chargeable asset will be exempted from real property gains tax under a proposed amendment to part i of. The disposer is devided into 3 parts of categories as per Schedule 5 RPGT Act. It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price.

Real Property Gains Tax RPGT in Malaysia 2021 Real Property Gains Tax RPGT in Malaysia 2021 1 year ago 1 UPDATED 13 APR 2021 BY. Property Disposal in. RM 50000 RM 250000 x 20.

Disposal of assets in connection with securitisation of assets. The most recent RPGT amendments in lieu of our Budget 2019 announced by Ministry of Finance MOF Malaysians who are selling off their property in the sixth and subsequent years of ownership will now have to pay a 5 RPGT. So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the chargeable gain.

Part 1 Schedule 5 RPGT Act Except part II and part III.

Real Property Gains Tax Its Exemptions Publication By Hhq Law Firm In Kl Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Amendment Bill To The Real Property Gains Tax Act 1976 And Stamp Act 1949 News Articles By Hhq Law Firm In Kl Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Issues Surrounding Real Property Companies Thannees Articles

Key Changes In The Real Property Gain Tax Cheng Co Group

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Rpgt In Malaysia Malaysia Property Update

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Understanding How Real Property Gains Tax Rpgt Applies To You In Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

All About Rpgt Real Property Gain Tax 2019 My Awesome Property

What Is Real Property Gains Tax The Malaysian Bar

6 Steps To Calculate Your Rpgt Real Property Gains Tax

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

Real Property Gains Tax Valuation And Property Management Department Portal

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia